The x402 Protocol

x402 brings the HTTP 402 Payment Required status code to life. Originally reserved in the HTTP spec in 1997 for "future use," it was never standardized — until now. Built by Coinbase, x402 turns every API call into a pay-as-you-go transaction using USDC stablecoins.

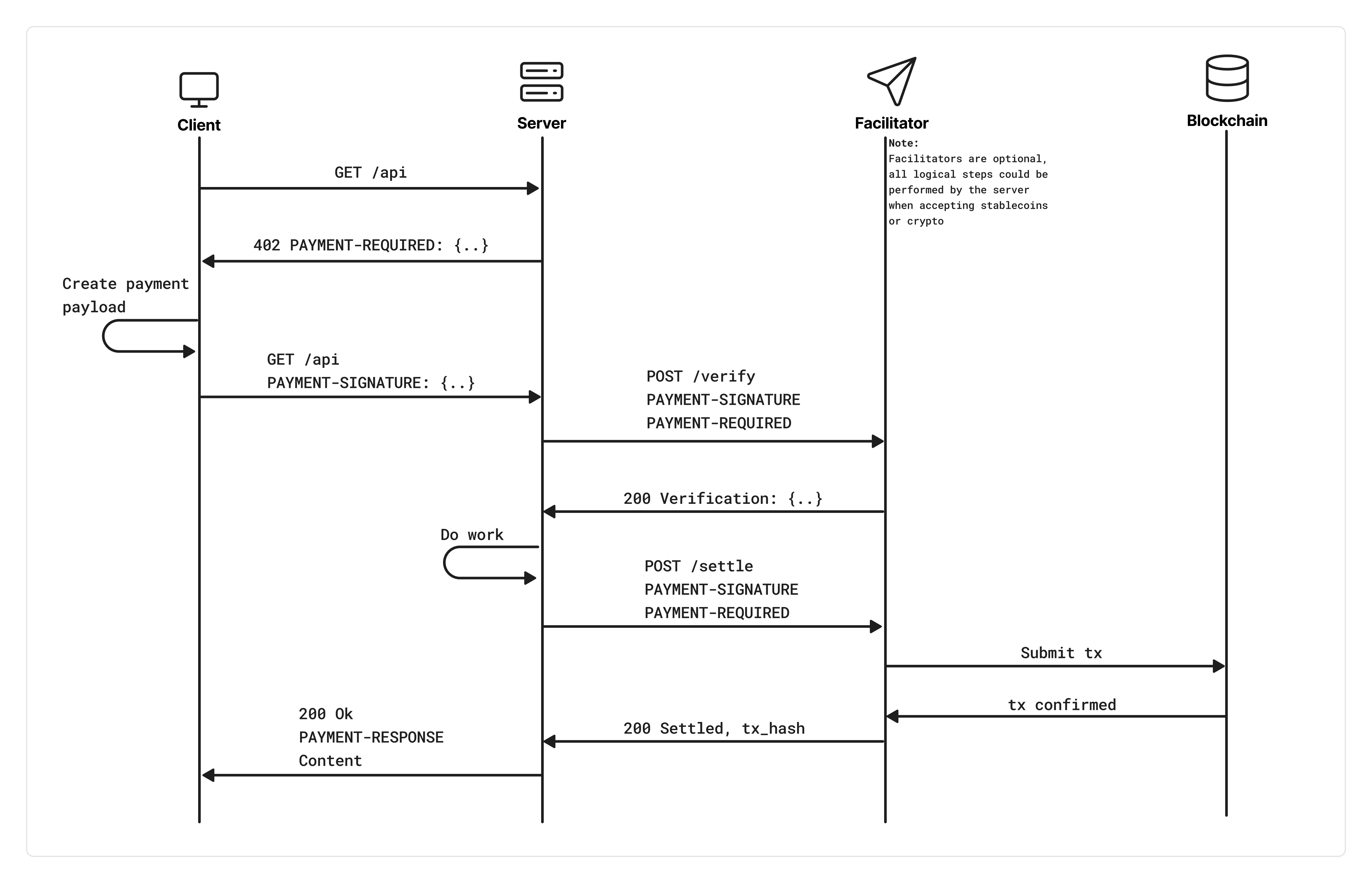

The client sends a request, the resource server responds with 402 and payment requirements, the client signs a USDC payment, and the facilitator verifies & settles on-chain before the server returns the data.